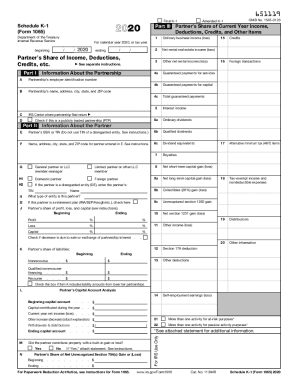

Irs Schedule K-1 2024 Form – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . The Schedule K-1 Tax Form Explained – File IRS tax form Schedule K-1 to report your income from “Pass-through entities,” such as S corporations, estates, and LLCs. Learn more about when and how to .

Irs Schedule K-1 2024 Form

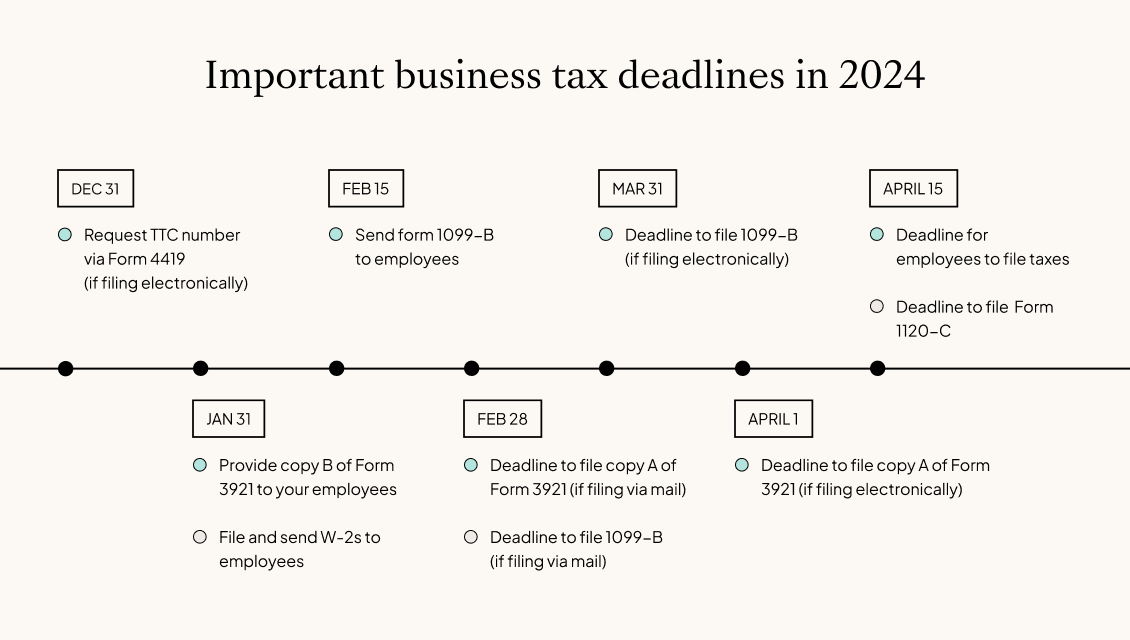

Source : schedule-k-1.pdffiller.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comFederal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet

Source : sites.google.comIRS Schedule K 1 (1065 form) | pdfFiller

Source : www.pdffiller.com2023 Instructions for Schedule K 1 (Form 1041) for a Beneficiary

Source : www.irs.govIRS Instructions 1065 Schedule K 1 | pdfFiller

Source : www.pdffiller.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govIRS Instruction 1065 Schedule K 1 2020 2024 Fill out Tax

Source : www.uslegalforms.com3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.govIrs Schedule K-1 2024 Form 2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable : To do so, it files an updated Form 1120S and checks the box on Line H for “Amended Return.” S corporations must also file amended Schedule K-1 forms with the IRS and send copies to the company’s . Two copies of the Schedule K-1 must be completed for each shareholder. One copy goes to the shareholder, while the other copy must be included with the Form 1120S sent to the IRS. Schedule M-1 is .

]]>